The open road beckons, promising adventures unknown and landscapes unexplored. For many, a caravan represents not just a mode of travel, but a ticket to freedom—an opportunity to live life on their own terms, exploring the world at their pace. Yet, the dream of owning a caravan can often be hindered by the practicalities of financing this movable sanctuary.

This comprehensive guide explores the diverse financing solutions available to aspiring caravaners, ensuring that the path to freedom is accessible to everyone.

The Caravan Dream

Owning a caravan offers a unique blend of freedom, adventure, and comfort, allowing travelers to bring a piece of home wherever they roam. From weekend getaways to extended explorations, a caravan enables you to witness the changing scenery through your window, all with your favorite comforts within reach. However, the financial commitment of purchasing a caravan can seem daunting, making the dream feel just out of reach for many.

Understanding Caravan Finance

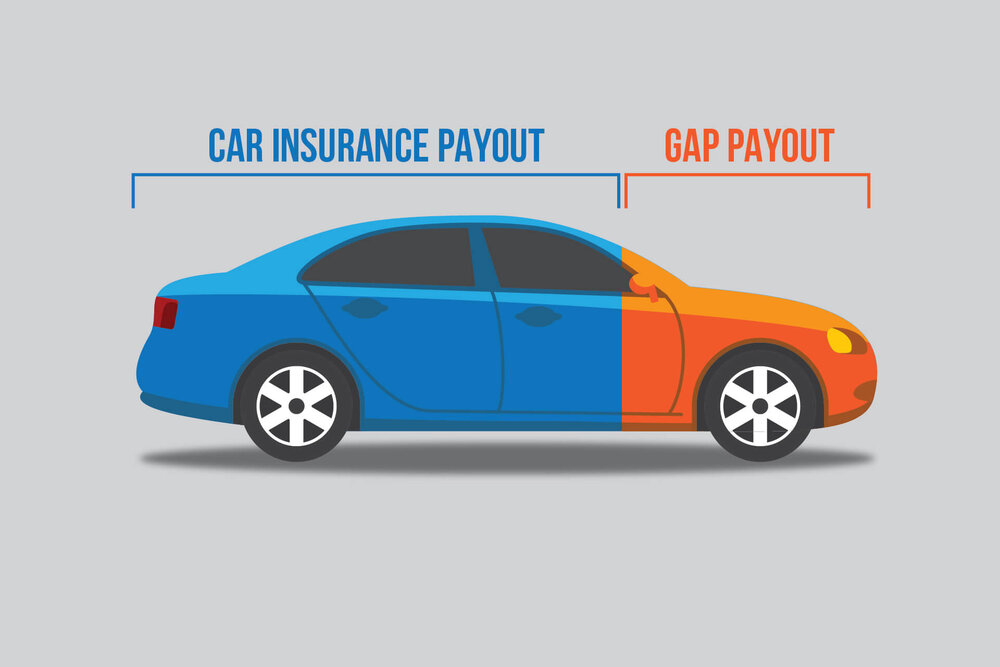

Caravan Finance involves navigating a sea of loan options, each with its terms, interest rates, and repayment plans. The right financing solution can make caravan ownership affordable, spreading the cost over time and allowing you to hit the road sooner than you might think.

Types of Financing Options

- Dealer Finance: Many caravan dealers offer in-house financing solutions, which can be convenient for buyers looking to streamline their purchase and financing processes.

- Personal Loans: Banks and credit unions offer personal loans that can be used for caravan purchases. These loans can be either secured or unsecured, impacting their interest rates and requirements.

- Specialized Caravan Loans: Some financial institutions provide loans tailored to caravan purchases, potentially offering more favorable terms due to their understanding of the caravan lifestyle.

Choosing the Right Financing Solution

Assess Your Financial Health

Before diving into the financing options, take stock of your financial health. Understanding your credit score, debt-to-income ratio, and budget can help you determine what you can afford and what terms might be most favorable.

Shop Around

Don’t settle for the first financing offer you come across. Take the time to shop around and compare different loans, focusing on interest rates, loan terms, and any additional fees or penalties.

Consider the Total Cost

Remember, the cost of owning a caravan extends beyond the purchase price. Insurance, maintenance, registration, and storage can all add up, so factor these into your budget when considering how much you can afford to finance.

Negotiate

Whether it’s the price of the caravan itself or the terms of your financing, there’s often room to negotiate. Don’t be afraid to ask for better terms or a lower price—every little bit can make a big difference in the long run.

Financing Solutions for Every Caravaner

For the Budget-Conscious

For those on a tight budget, securing a loan with the lowest possible interest rate is crucial. Look into credit unions and online lenders, which often offer competitive rates. Consider a longer-term loan to reduce monthly payments, but be mindful of the total interest paid over the life of the loan.

For the Credit-Challenged

If your credit score is less than ideal, there are still financing options available. Focus on improving your credit score, even slightly, as it can significantly impact loan terms. Look into lenders who specialize in bad credit loans, but be prepared for higher interest rates.

For the Seasoned Traveler

Experienced caravaners looking to upgrade or purchase a high-end model may find tailored financing solutions through specialized caravan loans. These loans may offer better terms based on the value of the caravan and your history with caravan ownership.

Smart Financing Tips

Understand the Fine Print

Before signing any loan agreement, make sure you fully understand the terms. Pay special attention to the interest rate, repayment schedule, and any fees or penalties for early repayment.

Save for a Down Payment

A substantial down payment can reduce your loan amount, leading to lower monthly payments and potentially better loan terms. Start saving early to maximize your down payment.

Plan for the Unexpected

Life is unpredictable, and so are the costs associated with caravan ownership. Set aside a contingency fund for unexpected repairs or expenses to ensure you can enjoy your travels without financial stress.

Stay Flexible

Your financial situation and needs can change over time. Consider financing options that offer flexibility, such as the ability to refinance for better terms or make extra payments without penalty.

Embracing the Journey

Financing a caravan shouldn’t feel like a roadblock on your journey to freedom and adventure. With the right preparation, research, and financial strategy, you can find a financing solution that fits your budget and lifestyle. Whether you’re dreaming of coastal retreats, mountain escapes, or cross-country explorations, there’s a financing solution to make your caravan dream a reality.