Singapore, known for its vibrant culture, robust economy, and high standard of living, is also an exemplary model when it comes to retirement planning. The city-state’s comprehensive approach to financial security, healthcare, and quality of life offers valuable lessons for anyone looking to secure their future.

This blueprint outlines key strategies and insights drawn from the Ultimate Guide to Planning Your Retirement in Singapore, tailored for individuals aiming to create a resilient and fulfilling retirement plan.

Understanding Singapore’s Retirement Ecosystem

Singapore’s retirement ecosystem is built on the Central Provident Fund (CPF), a comprehensive savings plan that covers healthcare, retirement income, and housing needs. While the CPF is unique to Singapore, the principles underlying its success can be applied universally: compulsory savings, investment in health, and leveraging assets like home equity.

Compulsory Savings: The CPF Model

The CPF mandates contributions from both employees and employers, which are then allocated into three accounts covering different needs: Ordinary Account for housing, Special Account for retirement, and MediSave for healthcare. Emulating this, individuals can create dedicated savings or investment accounts for specific retirement goals.

Strategic Investment for Long-term Growth

Singaporeans benefit from the CPF’s interest rates and the option to invest their CPF savings in various instruments for potentially higher returns. This underscores the importance of investing as a cornerstone of retirement planning.

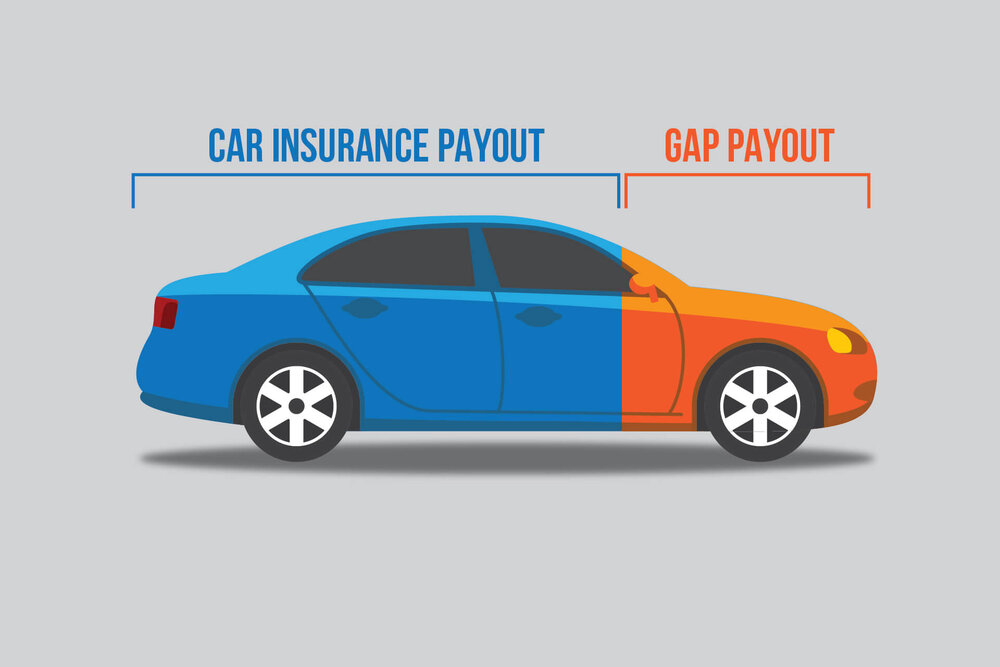

Diversification and Risk Management

Following Singapore’s lead, diversifying your investment portfolio can mitigate risk and enhance returns over time. This includes a mix of stocks, bonds, real estate, and other assets aligned with your risk tolerance and retirement timeline.

Leveraging Home Equity

Singapore’s use of CPF savings for housing purchases illustrates the potential of real estate as a retirement asset. Consider options like downsizing, renting out spare rooms, or reverse mortgages to unlock the value of your home in retirement.

Healthcare Planning: The MediSave Model

Healthcare is a critical aspect of Singapore’s retirement planning, with MediSave accounts earmarked specifically for medical expenses. This highlights the need for a proactive approach to healthcare planning in retirement.

Saving for Healthcare

Create a healthcare fund to cover future medical costs, including long-term care. Investing in a health savings account (HSA) or setting aside a portion of your savings for health-related expenses can provide peace of mind and financial protection.

Insurance Strategies

Singaporeans are covered by MediShield Life, a basic health insurance plan. Emulating this, individuals should ensure they have adequate health insurance coverage, including policies for critical illness and long-term care.

Quality of Life in Retirement

Singapore’s approach to retirement planning also focuses on quality of life, recognizing the importance of social engagement, lifelong learning, and leisure activities in ensuring a fulfilling retirement.

Lifelong Learning

Singapore promotes lifelong learning through subsidies and incentives for seniors to acquire new skills and hobbies. Incorporate lifelong learning into your retirement plan to stay mentally active and engaged.

Active Lifestyle

The city-state’s emphasis on parks, recreational facilities, and community activities underscores the importance of maintaining an active and social lifestyle in retirement. Plan for activities and hobbies that keep you physically and socially active.

Estate and Legacy Planning

Singapore’s comprehensive approach to retirement planning includes estate planning to ensure assets are distributed according to one’s wishes. This is an often overlooked but crucial component of a retirement plan.

Will and Trusts

Creating a will and possibly setting up trusts ensures that your assets are distributed according to your wishes, minimizing potential disputes among beneficiaries.

Advanced Care Planning

Singapore encourages advanced care planning, including living wills and medical power of attorney. These documents specify your wishes regarding medical treatment and end-of-life care, ensuring they are respected.

Implementing Your Plan

Drawing inspiration from Singapore, the implementation of your retirement plan requires discipline, regular review, and adaptation to changing circumstances.

Regular Reviews and Adjustments

Your retirement plan should be a living document, reviewed and adjusted regularly to reflect changes in your financial situation, health, and retirement goals.

Professional Advice

Consider seeking advice from financial advisors, estate planners, and other professionals to tailor your retirement plan to your unique needs and goals, much like how Singaporeans have access to financial planning services.

Conclusion

Singapore’s holistic and forward-thinking approach to retirement planning provides a blueprint for individuals worldwide. By focusing on compulsory savings, strategic investment, healthcare planning, quality of life, and estate planning, you can create a comprehensive retirement plan that ensures financial security, health, and happiness in your sunset years. Emulating Singapore’s model, tailored to your individual circumstances and goals, can help you build a robust foundation for a fulfilling retirement.