The right investor can make a big difference in seed funding. But how do you find one?

Founders should look for investors who have experience with the type of start-up they’re pitching. For Allstadt, that meant looking for VCs who focus on SaaS or whose portfolio companies have already reached profitability.

1. Demonstration of Product-Market Fit

Seed investors are looking for proof that your product or service addresses a specific problem and has the potential for growth. Demonstrating this is a key factor in securing the investment they are offering. This can be achieved through the creation of a business plan which includes realistic projections of costs, revenues, and growth, or through a SWOT analysis.

Investors are also looking for a clear and well-communicated capital need and how it will be met. Startups seeking seed funding should make sure they understand the regulatory requirements for financial promotions and ensure they are compliant with the Financial Services (Marketing) Regulations 2007.

Startups that are able to demonstrate product-market fit and traction are more likely to secure a follow-on investment round. Having commercial bonds with experienced founders will help in this. In addition, a clear and effective pitch deck will be invaluable in making the case to investors.

In some cases, startup accelerators and incubators can provide a platform to present your idea to a large number of investors, which will speed up the process of attracting seed investment funds.

2. Demonstration of Team Commitment

It takes a lot of time, energy and even money to turn a nugget of an idea into a real business. Founders need to have a clear vision of their product or service and be able to tell the story in a way that captivates potential investors.

Investors will want to see that the founders have a strong commitment to their company and are willing to make sacrifices for success. Having the support of a mentor or adviser can also help demonstrate this commitment.

In addition to team commitment, it is important for entrepreneurs to understand how to manage their equity. Since most startups will need to give up some of their company’s ownership in order to obtain seed funding, it is important for founders to have a plan in place for managing this process. This includes creating a capitalization table (or cap table), which includes all investment amounts, ownership shares and share prices. This will allow the founders to keep track of their company’s growth and how it affects their overall equity value.

3. Demonstration of Traction

Investors are looking for evidence that you can quickly scale up to meet demand and start generating revenue. The best way to demonstrate this is through a minimum viable product (MVP), which can be tested by potential customers and shown to meet the needs of that market.

Seed-stage funding enables essential tasks like market research, prototype development and hiring. This is typically provided by angel investors in exchange for equity in the business. However, larger corporations are increasingly using their own venture arms and funds to acquire early-stage startups that can bring innovation and new revenue streams to their business.

It is important to choose your seed investors carefully. Look at their net worth and past investments to find those with a similar investment style to your business. Once you have found an investor, try to close the deal as soon as possible. YC’s safe, for example, makes this easy by allowing you to exchange signed documents online and execute wire instructions in a matter of minutes. This can help build momentum and reduce the likelihood of future negotiations that can delay a final decision.

4. Demonstration of Financial Modeling

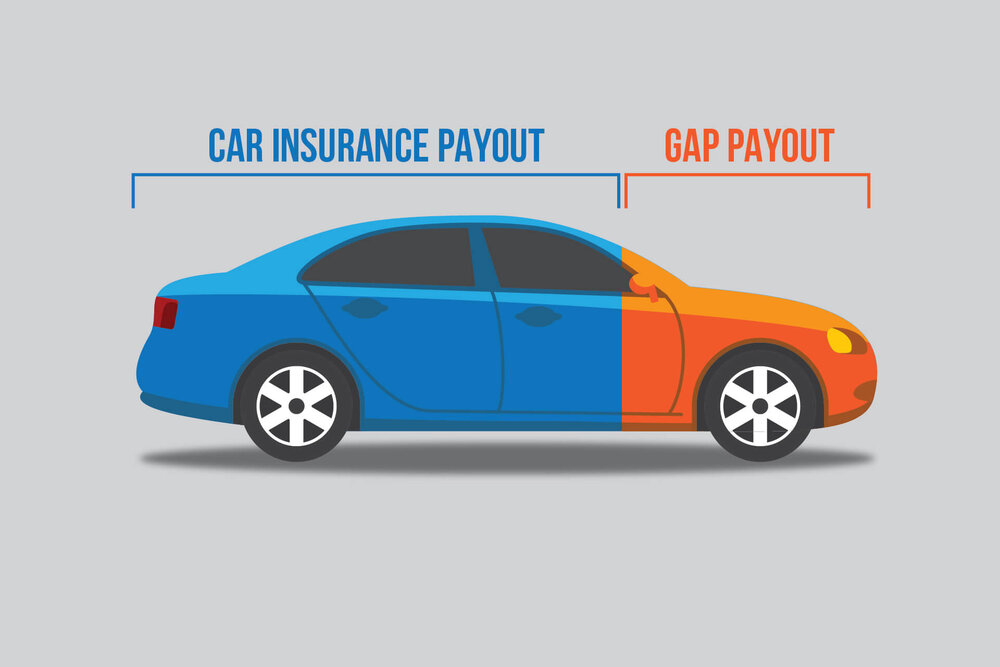

Whether you’re seeking a business loan, an equity investment or simply trying to determine your startup’s cost of goods sold, a financial model is essential. Financial models are used to create forecasts and provide a visualization of your company’s future growth and profitability.

Many startups start by using founders’ personal savings to fund themselves in the early stages, a process known as bootstrapping. This can be a great way to build traction and gain credibility with potential investors before seeking formal seed funding.

However, it’s important to realize that many startups require additional capital investments to reach a certain level of product development and traction. During this stage, it’s common for angel investors to invest in startups in exchange for equity shares.

Investors will want to see a detailed financial model of your business including assumptions such as sales projections, cost of goods sold and operating expenses. This model should also include your cap table, which includes all investment amounts, ownership shares and share prices. This is an important element for showing how your startup plans to manage its equity and how it will return value to your investors in a liquidity event such as an Initial Public Offering or merger acquisition.

5. Demonstration of Exit Strategy

At the seed level, investors are taking a greater risk than at other stages. They are investing based on conviction and future potential rather than sales figures and revenue. This is why investors at this stage want to see a plan for how the business will exit once it is successful.

This may mean a strategic buyer from within the industry, or it may be an opportunity to expand into adjacent markets, for example with new product lines. It could also be an IPO or closure of the company. Alternatively, the owner may choose to sell to their employees or management team.

Investors can be found by leveraging existing business connections, startup accelerators or incubators, and prospecting platforms such as Crunchbase. Once you have identified potential investors, spend time creating a pitch deck that explains the problem your business is trying to solve and how it will deliver a solution. You should also be able to provide a financial model that outlines how your business will grow, including the costs of acquiring and retaining customers, and the cost of the engineering and sales teams.