Embarking on a financial journey is a significant step towards achieving your life goals and securing your future. In the bustling financial landscape of Singapore, where opportunities abound and complexities arise, the guidance of an expert financial advisor is invaluable. This article sheds light on the crucial role of a trusted advisor in Singapore, showcasing the multifaceted expertise they bring to the table as you navigate the intricate pathways of your financial journey.

Tips for Choosing the Best Finance Automation Company

When choosing the best finance automation company for your business, it’s important to consider factors such as scalability, integration capabilities, and customer support. Look for a company that offers a solution that can grow your business and seamlessly integrate with your existing systems. Additionally, prioritize companies that provide excellent customer support to ensure a smooth implementation process and ongoing maintenance.

Another crucial aspect to consider is the level of customization offered by the finance automation company. Look for a provider that can tailor their services to meet the specific needs of your organization rather than offering one-size-fits-all solutions.

By opting for a company that offers customization options, you can ensure that the finance automation solution aligns perfectly with your business processes and objectives. Remember, investing time in researching and evaluating different providers will pay off in finding the best finance automation company suited to your business needs.

Understanding the Singaporean Financial Landscape

Before delving into the role of a financial advisor, it’s essential to grasp the nuances of the financial landscape in Singapore. Renowned for its stability, innovation, and global prominence, Singapore stands as a financial hub attracting investors, businesses, and individuals seeking to manage and grow their wealth. The city-state’s robust regulatory framework and diverse investment opportunities make it an ideal environment for financial planning and wealth management.

The Personal Touch: Tailored Financial Planning

At the heart of a financial consultant in Singapore role is the commitment to tailored financial planning. Your financial journey is unique, and shaped by your goals, risk tolerance, and aspirations. A skilled advisor in Singapore takes the time to understand your circumstances, conducting a thorough assessment before crafting a personalized financial plan. This bespoke approach ensures that every recommendation aligns seamlessly with your objectives, setting the foundation for a successful financial journey.

Investment Strategies Aligned with Your Goals

Investing wisely is a critical component of financial success, and a trusted advisor in Singapore excels in aligning investment strategies with your specific goals. Whether you aim for capital growth, income generation, or a balanced approach, the advisor leverages their expertise to design investment portfolios that mirror your aspirations. By staying attuned to market trends, managing risks, and adapting strategies to changing circumstances, they guide you toward maximizing returns on your investments.

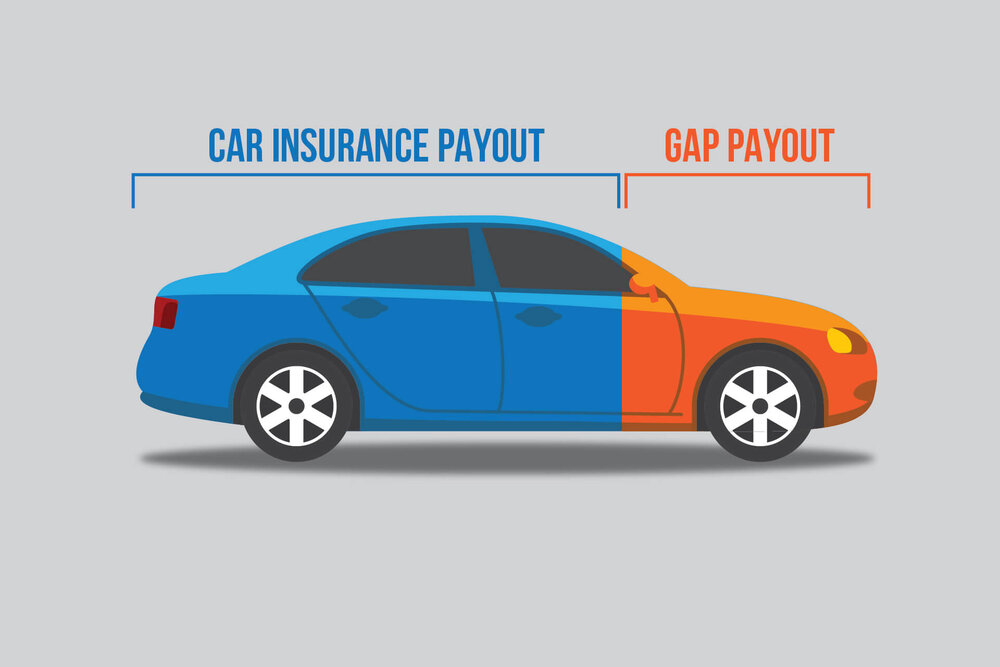

Risk Management for a Secure Future

In the dynamic world of finance, risk is inherent, and effective risk management is paramount. A skilled advisor in Singapore conducts rigorous risk assessments tailored to your profile, identifying potential pitfalls and formulating strategies to mitigate them. By navigating market volatility, economic uncertainties, and unforeseen life events, the advisor safeguards your financial well-being, providing you with confidence in the face of challenges.

Global Expertise, Local Insight: Navigating Diverse Markets

Singapore’s status as a global financial center demands an advisor with global expertise and local insight. A proficient financial advisor in Singapore possesses a nuanced understanding of both international and domestic markets. This dual perspective enables them to navigate diverse markets, providing you with access to a broad spectrum of investment opportunities while understanding the intricacies of the local financial landscape.

Holistic Wealth Management: Beyond Investments

Wealth management is not confined to investments alone; it encompasses a holistic approach to financial well-being. A dedicated advisor in Singapore integrates various elements, including retirement planning, estate management, tax optimization, and risk mitigation, into your wealth management strategy. This comprehensive approach ensures that every facet of your financial life is considered, fostering long-term financial security and prosperity.

Regulatory Adherence: Upholding Integrity and Compliance

In the highly regulated financial environment of Singapore, adherence to ethical practices and compliance with regulations is non-negotiable. A reputable financial advisor ensures that every recommendation and strategy aligns with the prevailing legal and regulatory framework. By upholding the highest standards of integrity and professionalism, they instill confidence in clients, assuring them that their financial journey is built on a foundation of trust and compliance.

Transparent Communication: Fostering Trust and Understanding

Effective communication is the cornerstone of a successful advisor-client relationship. A skilled advisor in Singapore prioritizes transparent communication, keeping you informed about your financial strategies, portfolio performance, and any adjustments deemed necessary. By fostering an open and collaborative dialogue, the advisor empowers you to make informed decisions, building trust and understanding throughout your financial journey.

Technological Integration: Enhancing Efficiency and Insights

In the digital age, technology plays a pivotal role in financial advisory services. A forward-thinking advisor in Singapore leverages cutting-edge financial tools and analytics to enhance the efficiency of services. Whether it’s real-time portfolio tracking, data-driven analyses, or interactive financial planning tools, technology integration provides you with insights and information crucial for making informed decisions on your financial journey.

Educational Empowerment: Nurturing Financial Literacy

Beyond managing your finances, a committed advisor in Singapore takes on the role of an educator. Financial literacy is a powerful tool, and the advisor ensures that you understand the complexities of your financial journey. By demystifying financial concepts, explaining investment strategies, and providing educational resources, they empower you to actively participate in your financial decisions, fostering a sense of confidence and control.

Building Long-Term Relationships: Your Partner in Financial Success

The relationship between you and your financial advisor extends beyond transactions; it’s a partnership in your journey towards financial success. A trusted advisor in Singapore focuses on building a long-term relationship, adapting financial strategies to evolving circumstances and guiding you through life’s various stages. By becoming a reliable source of support, the advisor ensures that your financial journey is not only successful but also fulfilling and aligned with your life goals.

Conclusion

In the vibrant financial landscape of Singapore, your financial journey deserves the expertise of a trusted advisor who goes beyond conventional services. From tailored financial planning and strategic investments to holistic wealth management and regulatory compliance, an ideal advisor in Singapore is your partner in securing your financial future. Elevate your financial experience, meet your ideal advisor in Singapore, and embark on a journey towards prosperity, security, and long-term success.